TKN DAO November 2023 report

TLDR

- Bye-bye bear market: We achieved a remarkable 70% YTD return.

- Profit for All Members: Every member is currently in profit.

- Crypto Market Resilience: The crypto markets have shown remarkable resilience despite global economic challenges.

Overview

The recent developments have been surprising and impactful in a financial landscape rife with challenges and uncertainties. Changpeng Zhao’s decision to step down and plead guilty to U.S. law violations marks a significant turn in the crypto industry. This plea is part of a substantial $4.3 billion settlement with Binance, the world’s largest crypto exchange, concluding a prolonged investigation.

The U.S. Securities and Exchange Commission’s (SEC) charges against Kraken for operating without proper registration further underscore the regulatory pressures mounting in the crypto space. These developments, while concerning, have not dampened the resilience of the crypto markets, particularly Bitcoin, which continues to hold its $37,000 support (as of November, 30th) as we approach the next Halving.

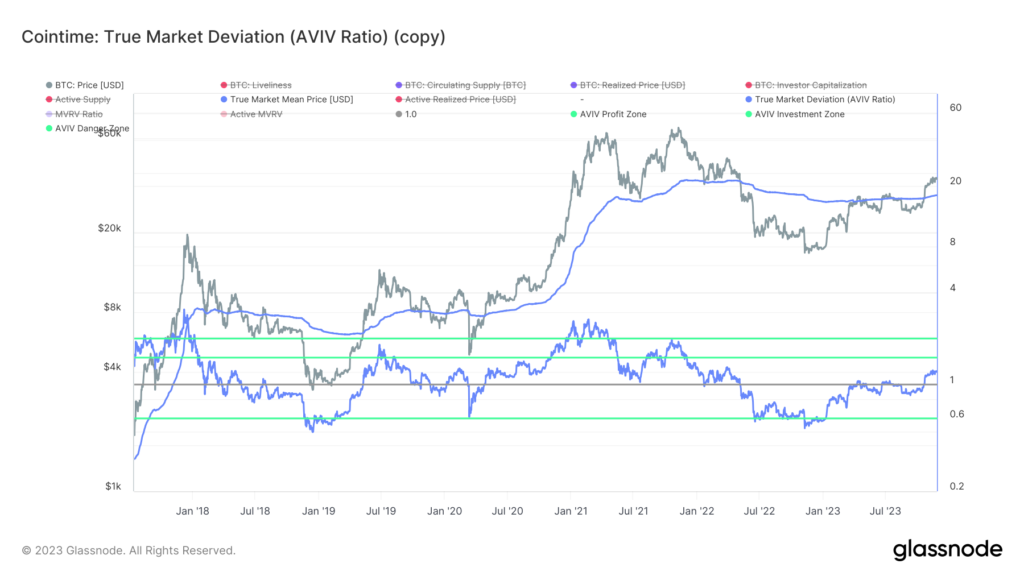

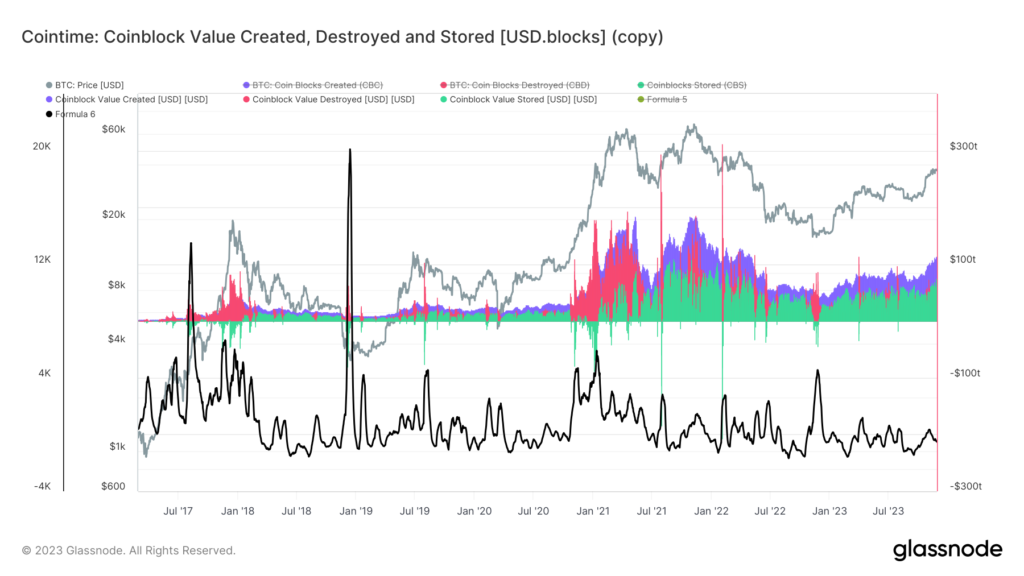

Despite these regulatory headwinds, several on-chain metrics indicate that the crypto market has not entered an overheated zone. This suggests room for further growth.

With volatility below historical averages, we anticipate a strong support level at $40,000 for Bitcoin in the upcoming Halving.

Bull & Bear Initiative

Our speculative portfolio, particularly in altcoins, has yielded a significant 6% profit in November 2023. Assets like BTC, AVAX, LINK, SOL, and SUSHI have been major contributors to this success. Our strategy of patient accumulation across multiple assets is poised to capitalize on the next bull market.

Yield Optimization Initiative

The yield markets are experiencing a positive feedback loop, with higher prices leading to increased volume and yields, attracting more Total Value Locked (TVL) and further price appreciation. Our Yield Optimization Initiative generated an impressive 26.5% APY in November 2023, with a 4% increase in nominal value within a month.

Our Road Ahead

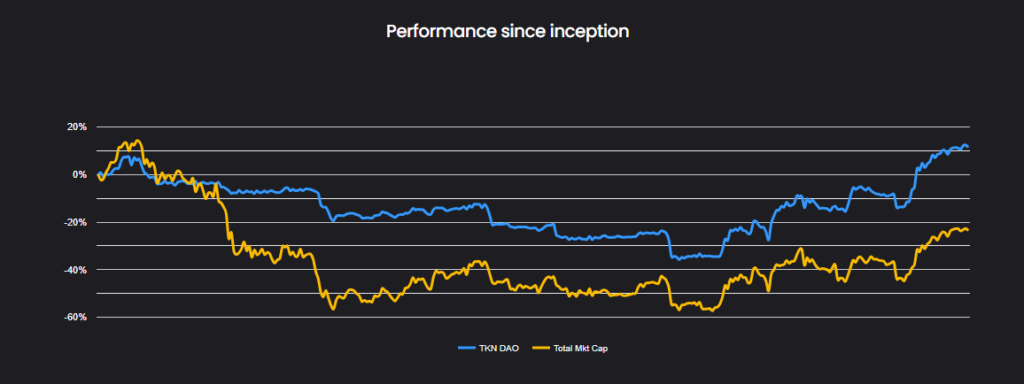

While our Year-To-Date (YTD) performance is slightly below the Total Market Cap by 2.8%, it’s noteworthy that we achieved this with an average of 50% stablecoin holdings, compared to the 8% stablecoin dominance in the Total Market Cap. This highlights our ability to capture opportunities while significantly reducing risk exposure.

As we move into 2024, we are excited to announce the implementation of new performance indicators and the automatic display of daily performance data on our website, thanks to our revamped API. We will soon introduce our fee structure, which will be detailed in an upcoming post and knowledge base article.

In conclusion, despite the tumultuous financial environment, our strategies have proven effective, demonstrating resilience and adaptability. As we navigate these challenging times, we remain committed to delivering value and security to our members, leveraging our expertise to turn challenges into opportunities.