TKN DAO August 2023 report

TLDR

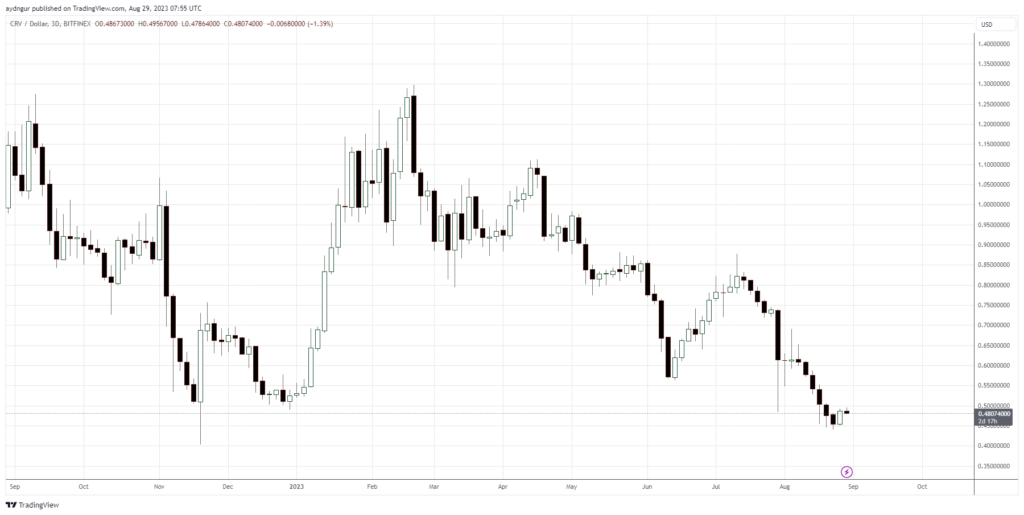

- $CRV exploit impacts markets but highlights the value of transparency in crypto.

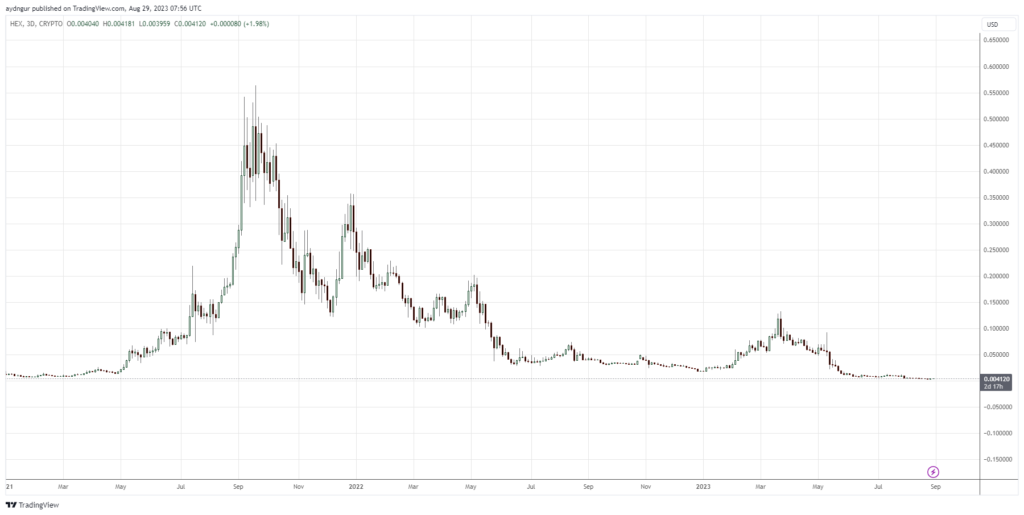

- SEC’s lawsuit against Richard Heart sees $HEX plummet, reinforcing our cautious stance against it.

- Evergrande’s bankruptcy sends ripples across global markets.

- Starlink’s Bitcoin sale caused a significant crypto market sell-off, challenging conventional market wisdom.

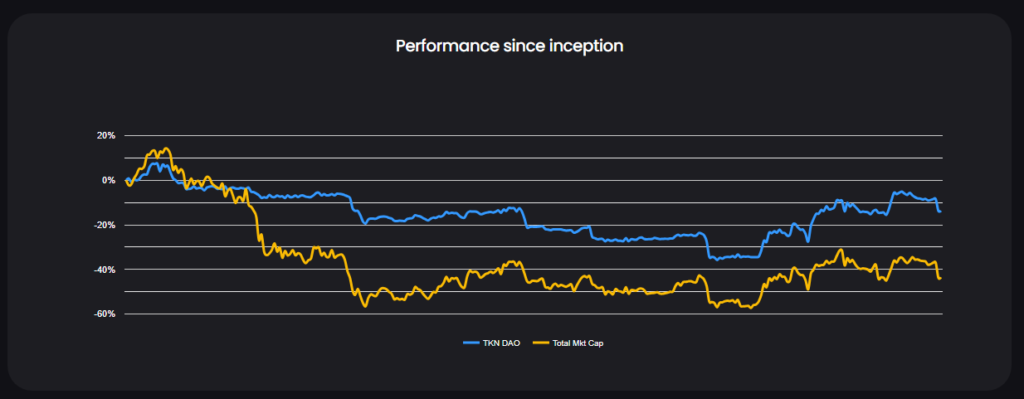

- TKN DAO outperforms the Crypto Total Market Cap by 31%.

- The Yield Optimization Initiative reports a yearly average yield of 8.5%.

Overview

Recently, the financial landscape has been marked by events that have challenged and reinforced our understanding of the market dynamics. The exploit of $CRV, a cornerstone in the DeFi realm, sent tremors through the markets. The potential bad debt of the platform’s founder posed a significant risk to the DeFi backbone, leading to a sharp decline in the CRV price, which plummeted below $0.5. However, this incident underscored the inherent advantage of transparency that the crypto market offers.

In another significant development, the SEC has taken legal action against Richard Heart, accusing him of raising over $1 billion through $HEX. This asset, which many had long suspected of being a scam, saw its value halve within days and is now down by a staggering 99% from its peak, moving from 0.55 to a mere 0.005! We take pride in our discernment, having steered clear of $HEX from the outset.

The global markets were not spared from turbulence either. The bankruptcy of Evergrande, a giant in the real estate sector, sent shockwaves across the world.

Meanwhile, Starlink’s announcement of selling $373 million worth of Bitcoin triggered a massive sell-off in the crypto markets. While the prolonged liquidity during the sideways price movement was a sign of strength in our eyes, the markets, as we’ve seen repeatedly, can sometimes defy logic.

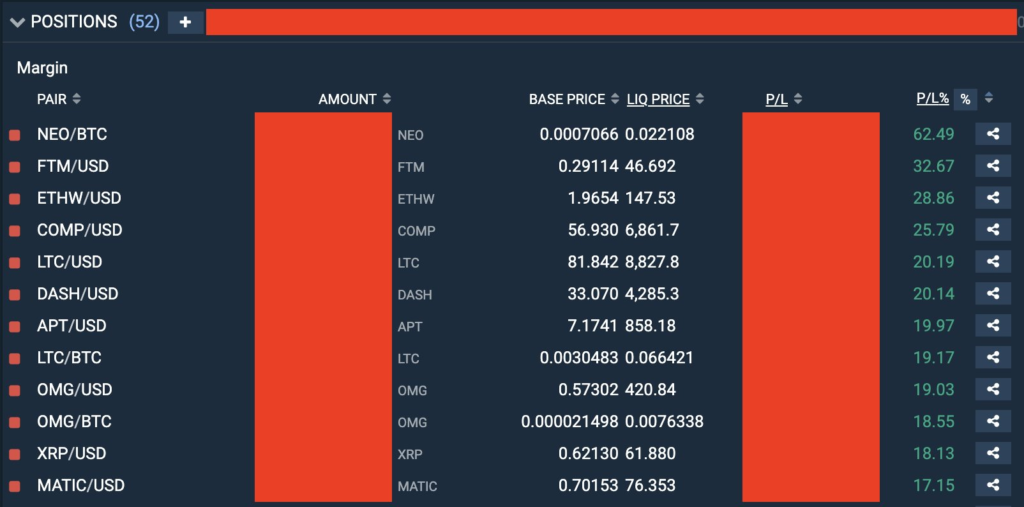

Bull & Bear Initiative

Our Bull & Bear Initiative remained resilient amidst the market upheavals. The crash in CRV’s price did not impact TKN DAO, as we had strategically exited our position on July 27th. The prevailing downtrends in the USD and BTC pairs enabled us to augment our Bull & Bear Initiative portfolio by 2%. Notably, before the significant sell-off on August 17th, we had secured over 50 short positions. These positions, aligned with our trend-following strategy, yielded substantial profits.

Yield Optimization Initiative

Our Yield Optimization Initiative showed an 8.5% annualized performance in August.

With the resurgence of volatility, we are optimistic about achieving enhanced returns in the upcoming months.

Our Road Ahead

As we navigate the financial landscape, we are bolstered by standing 30 points above our benchmark.

This gives us the confidence to steadfastly adhere to our strategies, ensuring we continue providing value to our stakeholders. The journey ahead, while challenging, is one we approach with determination and expertise.