TKN DAO June 2023 report

TLDR

- The SEC has targeted Binance and Coinbase for selling unregistered securities.

- The crypto market experienced a downturn, seen as an opportunity for accumulation.

- Traditional financial institutions like Blackrock, Citadel Securities, Fidelity, and Schwab are entering the crypto space.

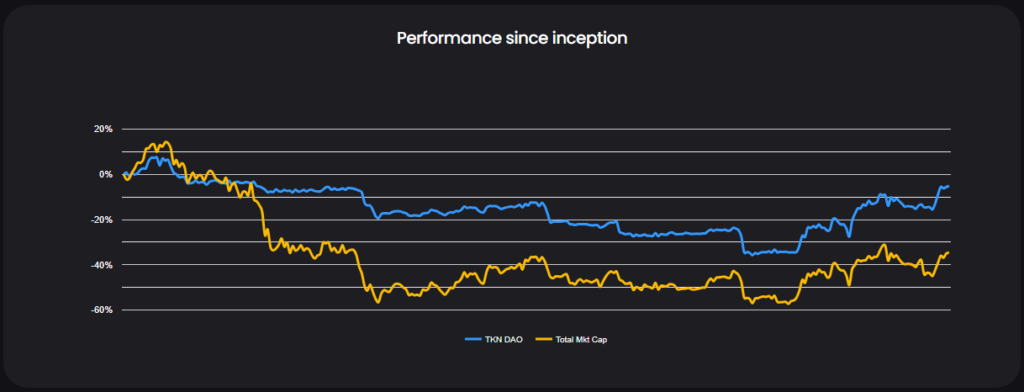

- TKN DAO outperforms the Crypto Total Market Cap by 31%.

- The Yield Optimization Initiative reports a yearly average yield of 19.2%.

Overview

Amid the ever-evolving financial landscape, the Securities and Exchange Commission (SEC) has recently cast its scrutinizing gaze upon prominent cryptocurrency exchanges, Binance and Coinbase. The crux of the allegations posits that these platforms have engaged in the selling of unregistered securities, with tokens such as SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, COTI, and XRP being the focal point in the Binance lawsuit.

While the news may cast a shadow over the cryptocurrency market, viewing this development through the lens of progress is imperative. The regulatory hurdles are not the death knell for cryptocurrencies; they are anticipated challenges we should surmount on the path to mainstream adoption. History has often shown that bear markets, particularly those with disheartening news, can present golden opportunities to acquire promising assets at favorable prices. The sentiments of retail investors, which serve as social proof, suggest that we are currently in an opportune phase for cautious accumulation.

Furthermore, the cryptocurrency market has witnessed a decline in the Total Market Cap while Bitcoin’s Dominance has ascended. This trend is indicative of potential fuel for continuation.

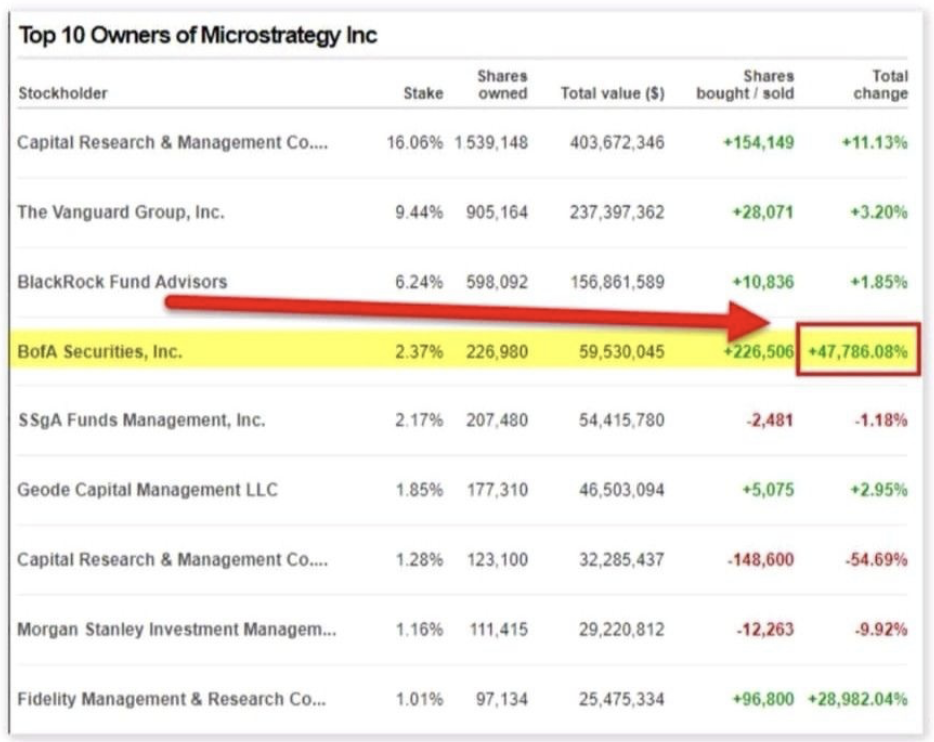

In the realm of traditional finance, noteworthy developments have emerged. A new cryptocurrency exchange has commenced operations, backed by the financial powerhouses Citadel Securities, Fidelity, and Schwab. Additionally, BlackRock, renowned for its near-perfect approval rate, has filed for a Spot Bitcoin ETF. In a remarkable move, Bank of America has escalated its exposure to MicroStrategy (MSTR) by a staggering 47,000%.

Bull & Bear Initiative

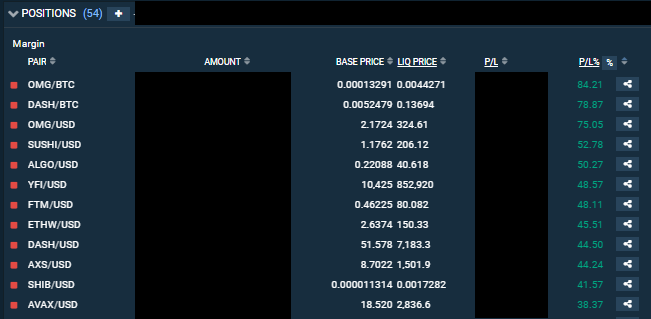

Amidst the tempestuous seas of the financial markets, our Bull & Bear Initiative has proven to be a sturdy vessel. Despite the volatility that has characterized the markets, our performance has been commendable. Of the 54 short positions, 50 have yielded substantial profits, demonstrating resilience in the face of market turbulence.

We strategically leveraged the surge in Bitcoin Dominance to accumulate more of the premier cryptocurrency. This accumulation is poised to bear fruit in the upcoming bull market.

Yield Optimization Initiative

Our Yield Optimization Initiative has been a beacon of success. With a yearly average yield of 19.2%, it exemplifies the efficacy of our strategies in optimizing returns.

Concluding Remarks

In conclusion, the financial world is akin to an ocean with its ebbs and flows. The recent events surrounding Binance and Coinbase, coupled with the entry of traditional financial institutions into the crypto space, indicate the industry’s dynamic nature. We continue to navigate these waters effectively through prudent strategies and a forward-looking approach. We are pleased to report that we have achieved a return of 45% YTD and outperformed the Crypto Total Market Cap by 31%.

As we forge ahead, we remain committed to capitalizing on opportunities and steering through challenges with acumen and agility.