TKN DAO July 2023 report

TLDR

- A US court ruled that the sale of XRP on exchanges did not constitute investment contracts, leading to a surge in cryptocurrencies.

- The SEC acknowledged Blackrock’s spot Bitcoin ETF application.

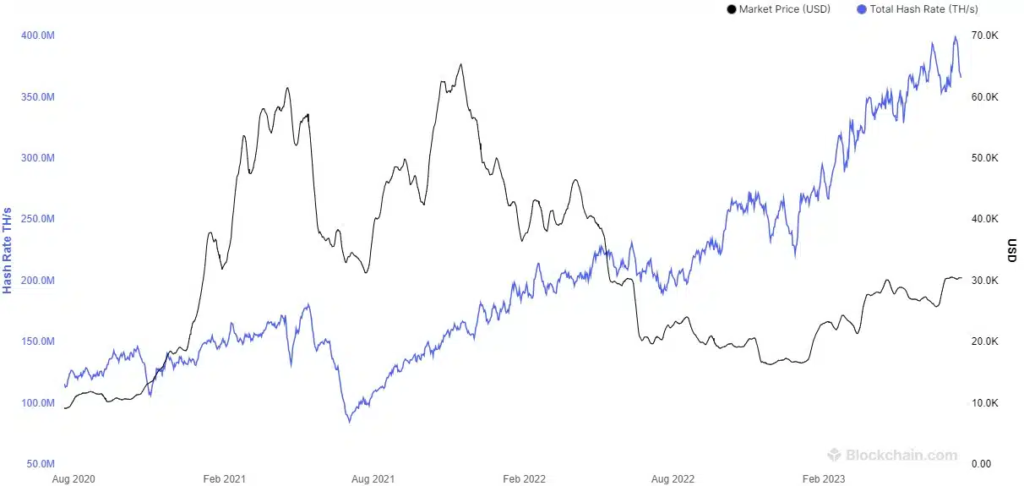

- Bitcoin Network’s hash rate hit another record, growing 50% in the last six months.

- Bitcoin’s weekly average volatility is at a historical low.

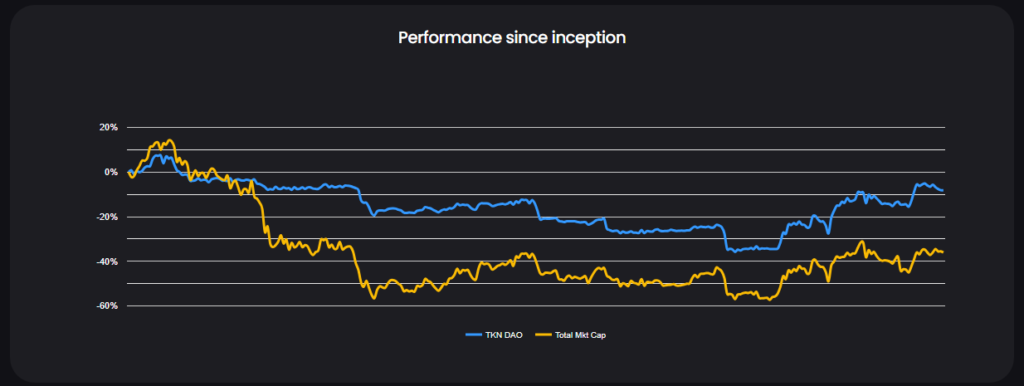

- TKN DAO still performs well above its benchmark.

Overview

In a significant development, a US court ruled that the sale of XRP on exchanges did not constitute investment contracts. Although likely to be appealed by the SEC, this decision led to a quick surge in cryptocurrencies. The market responded positively to this ruling, reflecting the potential for a more favorable regulatory environment for cryptocurrencies.

In another noteworthy event, the SEC has announced they acknowledged Blackrock’s spot Bitcoin ETF application. While we are yet to see whether this application will be approved, the acknowledgment itself is a positive sign for the industry. It indicates a growing acceptance of cryptocurrencies and their potential role in the financial landscape.

The Total Market Cap currently stands at $1.13T, with Bitcoin Dominance at 49.94%. This dominance underscores Bitcoin’s continued relevance and influence in the cryptocurrency market.

Interestingly, the traditional negative correlation between Bitcoin and DXY (US Dollar Index) changed direction in recent weeks. Despite a sharp fall in DXY to below 100.00, Bitcoin did not exhibit the expected increase in value. We anticipate this anomaly to correct itself and revert to the usual course.

Regarding network performance, the Bitcoin Network’s hash rate recently hit another record, growing 50% in the last six months. This growth is a testament to the robustness and resilience of the Bitcoin network.

Bull & Bear Initiative

After the strong downtrends of the previous month, which were beneficial to our portfolio due to numerous short positions, we anticipated a relatively flat price action. Flat charts, or ‘crab markets’ as they are known in Crypto Twitter parlance, typically yield less than stellar results for Trend Following systems. However, they also often precede periods of superior performance.

Currently, Bitcoin’s weekly average volatility is at a historical low. Such periods typically precede significant trends. Once these trends arrive, we will be well-positioned to capitalize on them.

Yield Optimization Initiative

The average annual yield in July 2023 was 11%.

During this period, we also conducted a thorough risk analysis and experimented with several DeFi protocols to assess their potential benefits. This exploration is part of our ongoing commitment to optimizing strategies and maximizing returns.

Our Road Ahead

Despite the challenges and uncertainties, we remain in a strong position with a 40% profit YTD and 28 points above our benchmark. Our time-tested strategies continue to serve us well as we navigate the complexities of the crypto market.

We anticipate the next bull run to commence in spring 2024. We are well-prepared for this eventuality and have sufficient capital to profit from it. Our focus remains on leveraging our expertise and strategic approach to deliver consistent, robust returns for our investors.