TKN DAO May 2023 report

TLDR

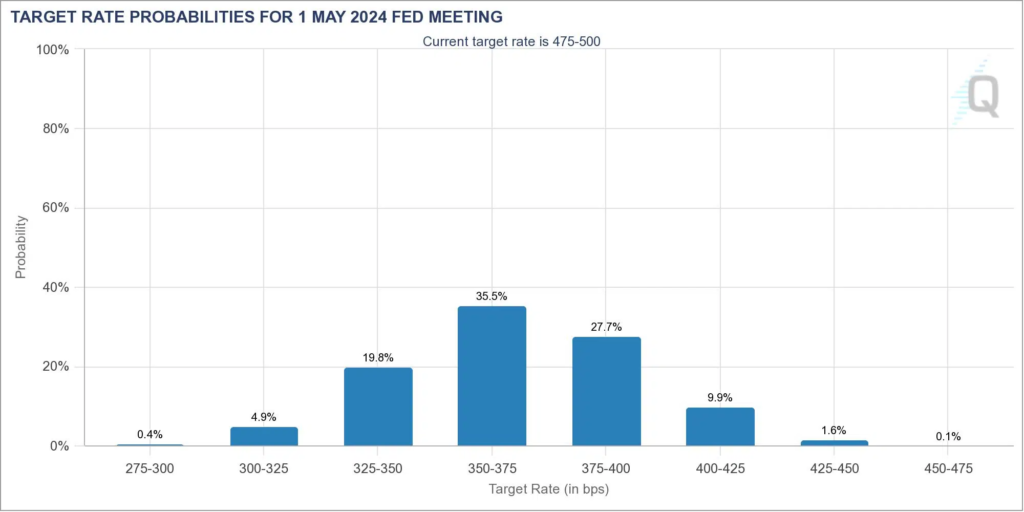

- The market expects interest rates to be -1.5% lower in a year, coinciding with Bitcoin Halving.

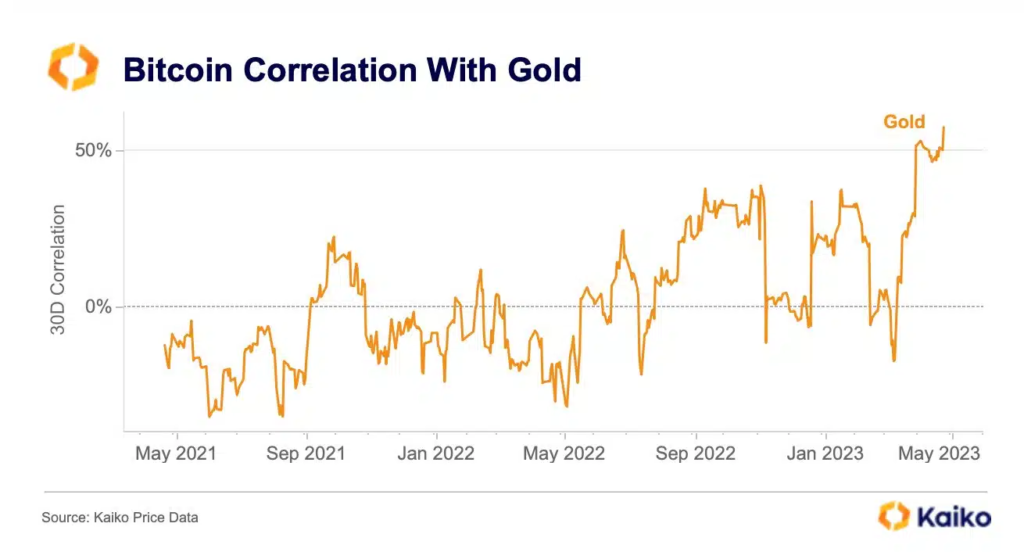

- Bitcoin’s correlation to Gold has significantly increased.

- FED has raised interest rates to 5.25%, with hints of an end to rate hikes.

- Despite the slowdown, the monthly PPI at 0.2% warrants caution.

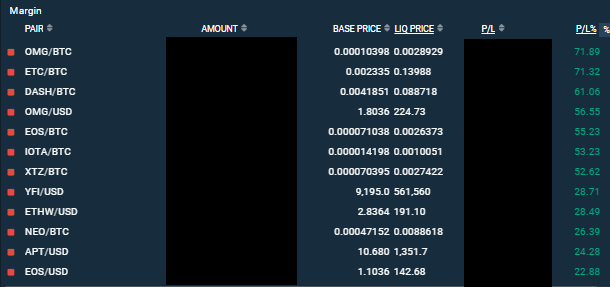

- Our Bull & Bear Initiative has reaped significant rewards with over 55 short positions.

- Yield Optimization Initiative brought a 15% annualized yield in May 2023.

- We are well-positioned to benefit from upward movements and seize opportunities in potential market crashes.

Overview

The financial landscape is currently navigating through a period of significant change. The market is pricing interest rates to be -1.5% lower than today, a shift expected to occur in one year when the Bitcoin Halving will occur. The market is preparing for more favorable conditions when Bitcoin will become the hardest asset on earth.

In this evolving landscape, Bitcoin’s correlation to Gold has also increased significantly, indicating a strengthening relationship between traditional and digital assets. This correlation could be a harbinger of a more integrated financial ecosystem where digital and traditional assets coexist and influence each other.

In a significant move, the FED has raised interest rates to 5.25%. The critical question is whether this is the last hike and how long they will hold at this level. The answers to these questions will determine how the economy and markets respond. Despite the Producer Price Index (PPI) slowing down to 0.2% this month, caution is still necessary.

In a hopeful turn of events, Powell has hinted at an end to rate hikes, suggesting that a significant part of the economic turbulence might be behind us. However, the FOMC meeting notes released on May 24th, 2023, reveal that some FED members are still concerned about inflation and do not rule out future rate hikes. While the situation is improving, vigilance is still required.

Bull & Bear Initiative

Our Bull & Bear Initiative has successfully navigated the current market conditions. With over 55 short positions, we have been able to reap significant rewards from the market.

While our preference for smaller nominal positions during a bear market limits the impact of these profits, we continue to outperform the Crypto Total Market Cap, demonstrating the effectiveness of our strategy.

Yield Optimization Initiative

Our Yield Optimization Initiative has also been performing well. In May 2023, it brought a 15% annualized yield. This consistent and robust revenue stream in the bear market will significantly impact our yearly performance, reinforcing our resilience and adaptability.

Our Road Ahead

In a bear market where 100-year-old banks collapse, and uncertainty abounds, we face our challenges bravely. We are well-positioned with enough positions to benefit from upward movements and sufficient cash reserves to seize opportunities that may arise from potential market crashes.

Despite the prevailing uncertainty, we remain steadfast and optimistic. We are satisfied with our current position and look forward to the future with hope. Our strategy, grounded in careful analysis and prudent decision-making, has served us well and will continue to guide us in the coming days.

In the face of adversity, we have not only survived but thrived. We have demonstrated our ability to adapt to changing market conditions and deliver consistent results. As we move forward, we will continue to leverage our expertise and strategic approach to navigate the financial landscape, seize opportunities, and drive growth.

In conclusion, while the financial landscape continues to evolve, we remain committed to delivering superior returns and value to our members.