TKN DAO September 2022 report

TLDR

- Under the shadows of the current macroeconomic landscape, we continue to use our proven strategy.

Overview

Another painful month in risk assets. After relief rallies of July and August, in September, we tested the lows of June 2022 again.

Macroeconomic pressures and concerns are dominant. Under normal circumstances, actors with long-term perspectives should get higher yields in lending markets. But one of the most important metrics that show the financial system’s health, the Yield Curve, pictures a pessimistic outlook for the year ahead. It’s inverted even more deeply than the Great Financial Crisis and the Dot-com bubble.

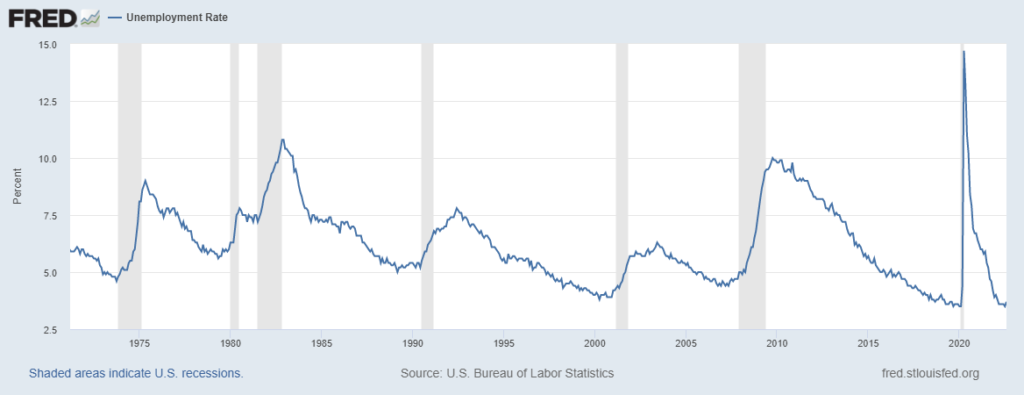

Meanwhile, the job market in the United States is still strong, creating extra pressure. As long as unemployment figures are low, FED sees more room to enforce deleveraging to combat inflation. That means more rate hikes until we reach their 2% target. They won’t change the course of Quantitative Tightening, and risk assets, including stocks and Bitcoin, will bleed.

Money flows to DXY, unlike anything we’ve seen in the last 20 years. It still has the potential to rise, to reach the highs of the Dot-com era.

In this environment, anyone who has to navigate the storm ahead should play defensively.

Bull & Bear Initiative

In the last couple of months, we’ve seen the rise of the Choppiness Index in the Crypto Market. This factor is known to reduce the profitability of trend-following systems.

Despite the changes we implemented in our parameters to adapt to the nature of these periods, we received less than desired results.

But we should note that these are strategic losses. When we see sustained price movements upwards or downwards, our pool will reflect a strong value appreciation again.

We will play our strategy patiently.

Yield Optimization Initiative

Even though Bitcoin’s performance caused a temporary loss in nominal USD value, we have more Bitcoin and USDC than ever in this initiative.

Updates in our strategy lowered the volatility and helped us get consistent results.

When rallies return, we will reap the rewards of our accumulation in this period.