TKN DAO July 2022 report

TLDR

- July was a quiet month to build a stronger foundation.

Overview

After the violent tribulations of previous months, July 2022 allowed us to focus on the bigger picture with less drama.

S&P 500 and NASDAQ 100 showed a minor recovery.

Bitcoin climbed following the Flag formation.

And altcoins that crashed harder in every bear market made notable gains from the bottom.

But still, uncertainty prevails. And the biggest question is now: “Was it just a relief rally, or is the bottom in?”

We will continue to play defensive.

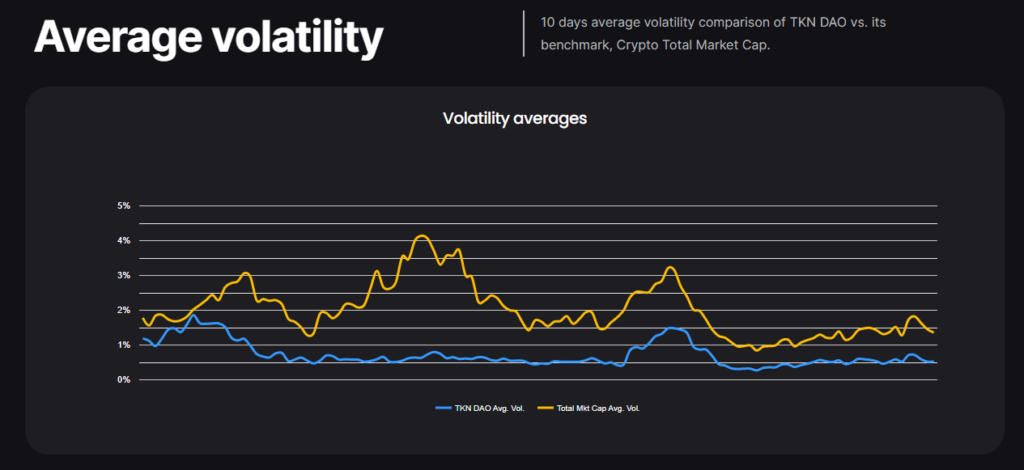

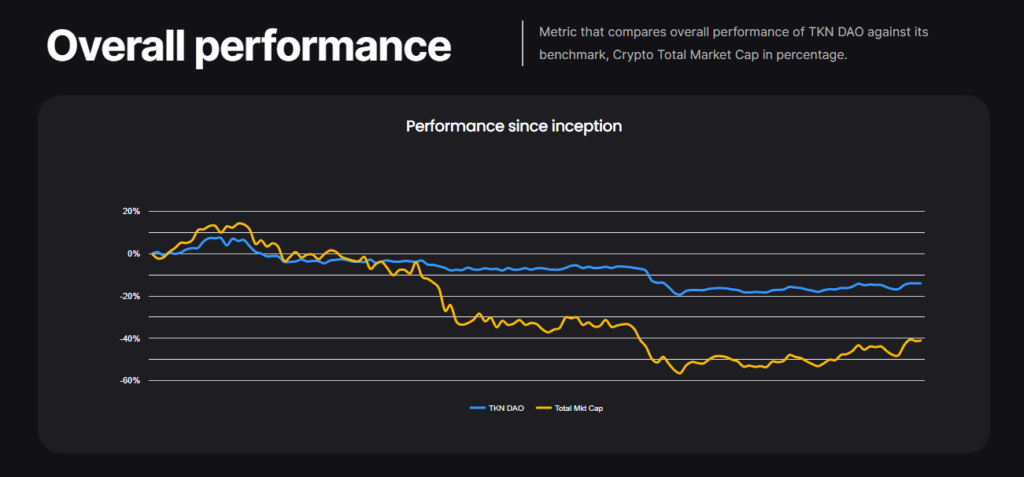

We managed to bring down the volatility we experienced at the end of June when Three Arrows Capital went bankrupt. And we made an overall gain of 3%, still 25% above the benchmark.

Bull & Bear Initiative

We closed almost every short position we opened in the last months. And we realized big profits.

As the downtrends neared their ends, we experienced minor drawdowns. These are inevitable in trend-following systems. And they are always factored in our risk management.

On the last days of the month, our system generated buy signals for a large number of altcoin markets. We adhered to these. On the other hand, we are aware that we are still in a bear market. Historical data shows that relief rallies usually end prematurely. We took less risk than usual.

Yield Optimization Initiative

Low volatility and price movement in a tight range since the beginning of this month created ideal conditions for this strategy.

We experienced no Impermanent Loss, and we could secure a 1% income of our current portfolio.

We developed new software parameters with the data points the high volatility of the last month provided. These guided us in determining position sizes. We were able to monitor our progress more closely and transparently.

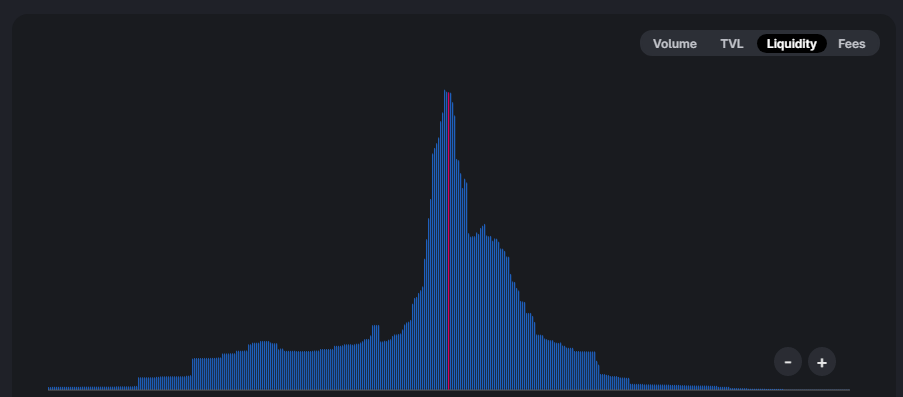

The largest pool we operate in saw a %20+ loss in TVL. Quite positive for us. Even after some recovery, now we own a larger share of it.

In addition, investors positioned most of the value in this pool with an expectation of appreciation. This large portion of assets received no share of the fees accrued this month. But thanks to our algorithm that focuses on recent price movement more precisely, we stayed in the game all the time.

Our road ahead

The month of August produced mixed results in the last decade of Bitcoin. This is especially true when the market closes in July with a strong positive.

As usual, we remain optimistic. But we need to balance this by being cautious and risk averse.

Market conditions continue to be fertile ground for long-term accumulation. We are yet to see an opportunity to make a bold move with larger and leveraged positions.

As usual, we will continue to publish daily data on our statistics page.