TKN DAO June 2022 report

TLDR

- We leave behind this challenging month in crypto-asset markets with a stronger foundation for the future in multiple dimensions.

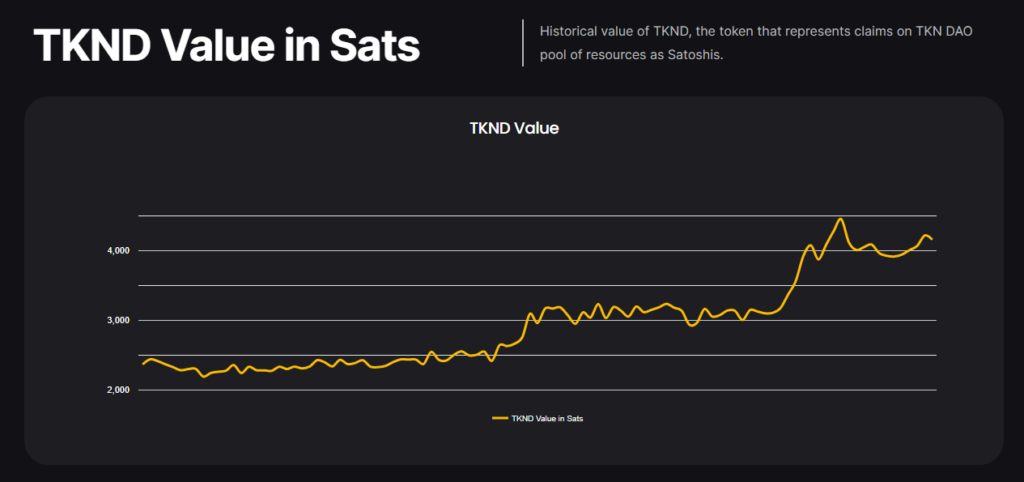

- Since our inception, we allowed our members to acquire 75% more Satoshis.

Overview

Stormy weather is still testing markets. Insolvency news from Celsius and Three Arrows Capital shocked the crypto-assets space.

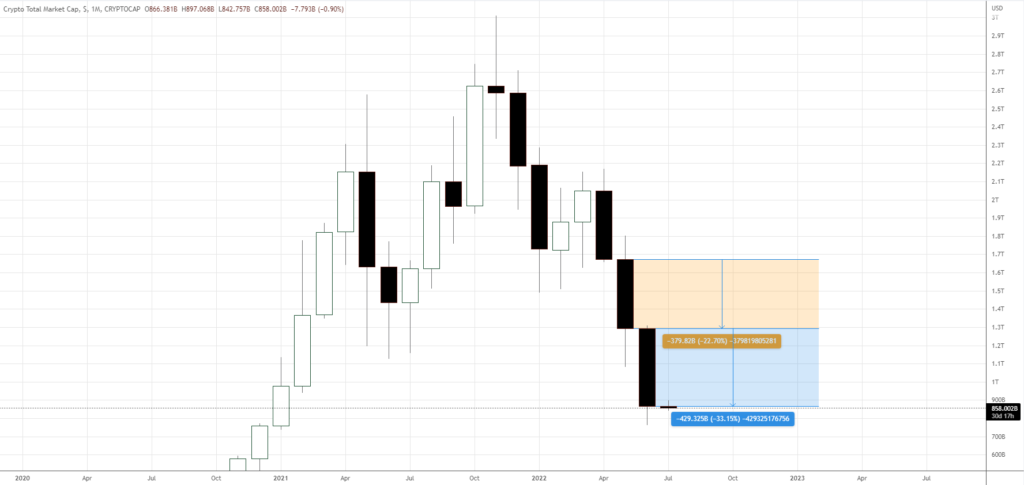

Numbers tell us the catastrophic cost of this period. In May, when LUNA crashed, Crypto Total Market Cap lost 22.69% of its value. In June, an additional 33.06% loss occurred!

With so many pillars crumbling, we should expect more bad news on the way.

It’s not just crypto. S&P lost 8.39%. To put things in perspective, that kind of wealth destruction happened only in the Dotcom crash, the Great Financial Crisis of 2008, and the Covid panic. And no one was spared. Berkshire Hathaway lost 13.73% of its value in only 30 days!

A recent report from Bridgewater Associates evaluates FED changing its course from raising interest rates and Quantitative Tightening a low probability. Inflation is getting out of control worldwide, and we can see more substantial interventions.

We believe that we will see the true color of FED once we reach the 55-month moving average of S&P. Will they ease the pain just like the previous 13 years, or will they allow a crash of 2008 proportions? That’s the trillion dollars question.

On the crypto side, we received an answer to a critical question: What will happen to historical supports once QE ends which was the dominant macro reality since Bitcoin’s genesis block?

Bitcoin broke its long-term logarithmic pitchfork downside. In the past, these log levels have always presented great investment opportunities. This uncharted territory will generate valuable data points.

At TKN DAO, we continued to improve our processes and updated our Statistics page. We added the Satoshi value of TKND. Since our inception, we allowed our members to acquire 75% more Satoshis. We will continue to serve true believers of Bitcoin.

Bull and Bear Initiative

ETH breaking its 1-year long structure in Bitcoin-denominated value downwards is grave news for all altcoins. It can lead to harder selloffs in all altcoin markets.

In the long run, all altcoins lose value against Bitcoin. As liquidity and volumes lose steam, we can expect faster losses.

When S&P reaches its 55-month MA, a relief rally will probably occur. But we may need a deeper crash to discharge the excess energy equity markets accumulated over 13 years.

Crypto-assets have never been in this kind of macroeconomic environment. So we will tend to play defensively.

June brought profits to our Bull & Bear initiative. We received a 1% profit in USD-denominated value while accumulating Bitcoins daily.

Yield Optimization Initiative

There were good news and bad news for our Yield Optimization initiative.

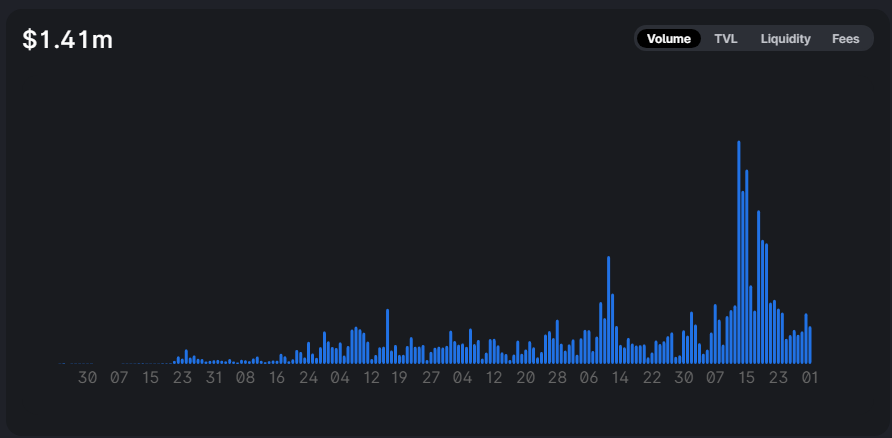

The good news is the substantial volume increase in the main liquidity pool we operate.

Our algorithm continues to balance Impermanent Loss and capital allocation. On 13 June, when Bitcoin showed its historic %15.53 fall, we faced our most challenging day. It tested the limits of our strategy but the 1% daily fees we acquired allowed us to grow our capital.

On the other hand, the crash affected our portfolio composition and increased our overall volatility to undesired levels. Even though this is quite rare in the history of Bitcoin, we took an important lesson. We analyzed all data points and created a new set of metrics to guide us in the future.

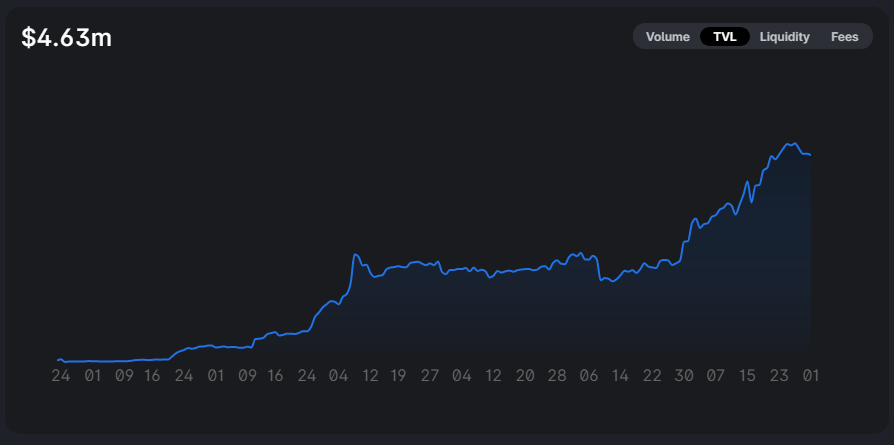

The main concern is the increase in TVL of our pool. It went +100% up. Investors started to see the opportunity.

Yet we have the know-how and technical capability to get most of it. We still have around an 8% positive return over Impermanent Loss.

A return to range trading and moderate volatility will give more fertile ground to our strategy.

Our road ahead

We don’t believe the worst is behind us. There are more storms on the horizon. We don’t expect a substantial recovery in global markets before the summer of 2023.

The negative sentiment -especially among retail traders- suggests that a once-upon-a-lifetime chance to acquire wealth will show itself.

We have almost no USDT exposure. We use USDC, which is regulated and much more secure. And we are in a strategically favorable zone to accumulate more Bitcoin. We and our members will not miss that chance. And we will have many more Bitcoins when the next halving comes.