TKN DAO May 2022 report

TLDR

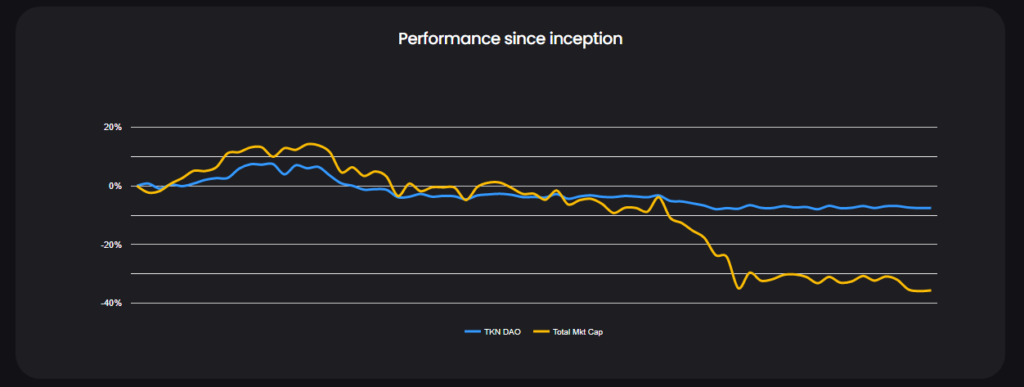

- We dodged May 2022 crash. With a 28% higher performance than Crypto Total Market Cap, we successfully protected our contributors.

- In May 2022 we’ve been net short LUNA and its fall from the grace impacted us positively.

Overview

It’s been a tough month in all global markets. S&P plunged into the bear market territory. QQQ created even more concern as tech stocks got oversold. And cryptocurrency markets took a serious blow from the LUNA/UST catastrophe.

But as TKN DAO, we’ve been able to act with the right expectations. Avoiding losses should be the primary objective of these periods to make a greater comeback under more favorable conditions.

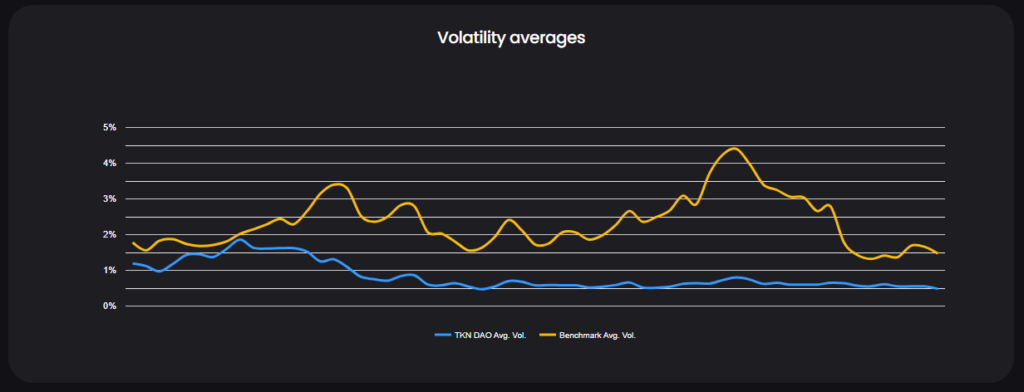

As you witnessed on our daily updated Statistics page, we surpassed our benchmark Crypto Total Market Cap by 28%! And our volatility was only a third of it, a much smoother ride.

Now let’s discuss each of our initiatives for a more detailed picture.

Bull & Bear Initiative

In a nutshell, our Bull & Bear initiative closed this period of market meltdown with net profit.

The secret to our success was being net short in almost every market.

We had 50+ short positions in various BTC and USD-based pairs, and our trend-following strategy produced admirable results.

We had negative LUNA exposure. As a matter of fact, LUNA had given us a short signal on 28 April 2022 when it was still trading at 89 dollars. And we had no UST. Our short positions brought more than 90% profits.

Our proprietary system tracks the most important metric of hundreds of crypto assets to give us early warnings: the price. It proved that it can protect our contributors’ capital from disasters.

We should note that this system brings homerun in uptrends as well.

We covered almost half of our short positions profitably, and the remaining half is yet to give us close signals.

Yield Optimization Initiative

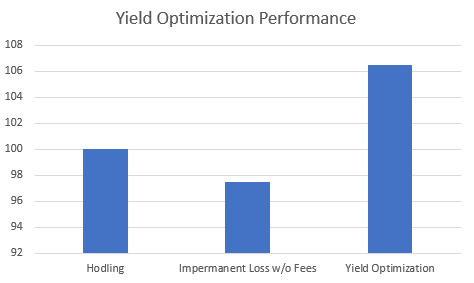

In Yield Optimization, you want to have a broader perspective than the nominal USD value. You take the long road. You accumulate assets that bring value consistently. And that’s what we have been doing for the past month.

We managed to smooth the fluctuation of basic hodling. We got Bitcoin below the average market price and grew our long-term investment. And we collected more dry powder to use in the most favorable buying opportunities.

Even though high volatility brings more Impermanent Loss, we were able to have a 6.5% surplus compared to hodling.

Only between 5-12 May 2022 when the volume was historically high, we have received a whopping 2% from the market!

We get an average of 0.1% every day which amounts to 3% per month. With sustained volumes on our pools, we can benefit from this performance for a longer time. And that will place us in a much stronger position for the next bull market.

We will be able to acquire more Bitcoin when we reach the accumulation zone.

Our road ahead

At the end of May, we will rebalance our portfolio. We will transfer a portion of our profits from the Bull & Bear Initiative to our Yield Optimization assets. That will bring us more market share in the pools we do business.

As long as we see no buy signals in altcoin markets, we will sit on cash. In this market climate, we believe in protecting the profits we received in 2020 and 2021. When the right time comes, we will have full power to pull the trigger.